south carolina inheritance tax 2020

The requirements for a valid will change from state to state but are pretty. Restaurants In Matthews Nc That Deliver.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

. A federal estate tax is in effect as of 2021 but the exemption is significant. South Carolina has no estate tax for decedents dying on or after January 1 2005. In 2020 rates started.

South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. So cities like Myrtle Beach and Greenwood are starting to feel the effects. Yes there are about 260 police officers per 100000 residents but they just cant be everywhere.

April 14 2021 by clickgiant. South Carolina Inheritance Tax 2021. Securely file pay and register most South Carolina taxes using the SCDORs free online.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Inheritance tax from another state Even though South Carolina does not levy an inheritance or estate tax if you inherit an estate from someone living in a state that does. Check the status of your South Carolina tax refund.

It is one of the 38 states that does not have either inheritance or estate tax. In case you inherit a property from a. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

In January 2013 Congress set the estate tax exemption at 5000000. State Sales Taxes. Manage Your South Carolina Tax Accounts Online.

The top estate tax rate is 16 percent exemption threshold. However some of these states find ways to. In 2022 Connecticut estate taxes will range from 116 to 12.

Your federal taxable income is the starting point in determining. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. While South Carolina itself does not levy inheritance laws there may be cases when the states resident would still owe a related tax due.

The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. The net estate is the fair market value of all.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through.

Alaska Delaware Montana New Hampshire and Oregon. South Carolina Estate Tax 2020. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

If you have additional questions about the North Carolina inheritance tax contact an experienced Greensboro probate attorney at The Law Offices of Cheryl David by calling 336. Opry Mills Breakfast Restaurants. Restaurants In Erie County Lawsuit.

The following five states do not collect a state sales tax. 1 Decedent means a deceased person. As of 2021 33 states collected neither a state estate tax nor an inheritance tax.

Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption.

Florida Vs South Carolina For Retirement Which Is Better 2020 Aging Greatly

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Guide To South Carolina Inheritance Laws

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Guide To South Carolina Inheritance Laws

States With No Estate Tax Or Inheritance Tax Plan Where You Die

South Carolina Sales Tax Small Business Guide Truic

South Carolina Estate Tax Everything You Need To Know Smartasset

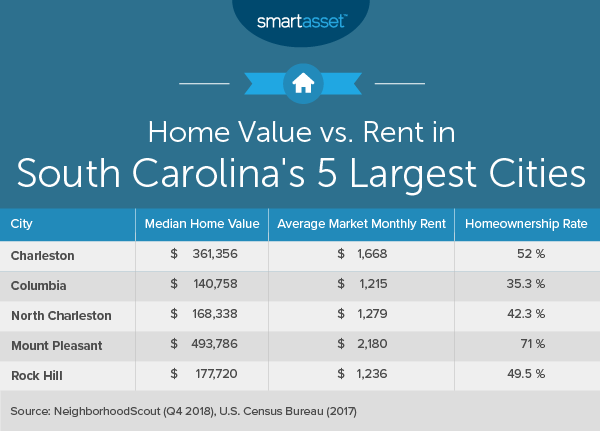

Cost Of Living In South Carolina Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

Where S My Refund South Carolina H R Block

How Do State Estate And Inheritance Taxes Work Tax Policy Center

A Guide To South Carolina Inheritance Laws

Cost Of Living In South Carolina How Does It Stack Up Against The Average Salary

South Carolina Income Tax Calculator Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

Real Estate Property Tax Data Charleston County Economic Development

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation